Charles Henry Dow (1850-1902) is considered to be one of the fathers

of technical analysis. Along with Edward D. Jones, he co-founded the

Wall Street Journal, which published his theory between 1900 and 1902.

With the objective of predicting the future evolution of the economy, he

created the Dow Jones index, the oldest stock market index in the

world.

Charles Henry Dow (1850-1902) is considered to be one of the fathers

of technical analysis. Along with Edward D. Jones, he co-founded the

Wall Street Journal, which published his theory between 1900 and 1902.

With the objective of predicting the future evolution of the economy, he

created the Dow Jones index, the oldest stock market index in the

world.

Despite the significant evolution of the financial markets,

Charles Dow's theory is still valid today. Nevertheless, after his

death, William Hamilton improved upon Dow's theory.

1) The market takes into account all known information

According to Charles Dow, current prices reflect all of the information that's available and expected. When new information becomes available, prices adjust in the short-run, but without affecting the medium/long-run tendencies.This is one of the basic priciples of technical analysis, which is only interested in market data, rather than fundamental data such as economic statistics or company performances.

2) The three types of tendencies

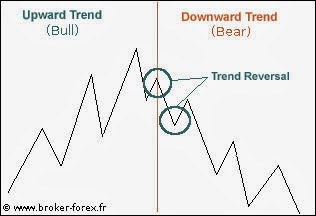

This graphic illustrates that the price of an underlying asset can climb upward in the short run, but be headed downward in the medium to long run. This notion of time bridging is the key required to understand how the markets work.

Dow theory must be used in markets that exhibit trends. It isn't interested in tertiary trends which can be subject to price manipulation.

The primary trend

This is the market's priciple orientation over the long run.

The secondary trend

It correct the primary trend over the medium term. It consists of consolidation (lateral evolution of trading prices) or a pullback (a price reversal).

The tertiary trend

This is comprised of short-term fluctuations within a secondary trend.

3) A tendency must be confirmed by High and Low spikes

An upward tendency:

The high is higher than the previous high, the low is higher than the previous low.

A downward tendency:

The low is lower than the previous low, the high is lower than the previous high.

A trend reversal:

The last high is lower than the last high, the trend is no longer confirmed. The reversal will be confirmed by the next low.

In an upward trend, the stop loss

must be positioned under the previous low in order to not exit during a retracement (pull back) but rather on a changing trend. mais sur un changement

de tendance. It will then be pulled up to the previous low as the upward trend continues. e

According to Charles Dow, the only price that matters is the

closing price, because that is the data whose psychological effect is

the strongest. The volumes allow you to confirm the strength of the

trend or its slowing down.

sources of : http://www.forex-central.net/charles-dow-theory.php

No comments

Post a Comment

SIlahkan Tuliskan Komentarnya ...